New Arrivals

-

Baby Dig Clip Infants Ear Nose Navel Clean Tools Kids Safety Tweezers Cleaning Forceps Toddler Nasal Cavity Care Supplies

$4.96ClearVS1335AChoose an optionChoose an optionVS1335ARated 0 out of 5 -

Infant Finger Toe Trimmer No Odor Light Healthy Safety Jaws Prevent Bouncing Baby Nail Care Tools Kids Nail Clippers Anti-fall

$3.45 – $4.11Style AStyle BStyle CStyle DChoose an optionChoose an optionStyle AStyle BStyle CStyle DClearCHINAChoose an optionChoose an optionCHINARated 0 out of 5 -

Disney Cartoon Stitch Air Cushion Comb Salon Hair Care Styling Tool Anti Tangle Anti-Static Hairbrush Head Comb Hairdressing

$14.97 – $19.71ClearABCDChoose an optionChoose an optionABCDRated 0 out of 5 -

Baby Plastic Cleaning Tweezers Safety Care Round Head Clamp Anti-skid Design Clean Ear Holes Nostrils Forceps Babies Daily Care

$6.33 – $21.964 pcs Setblue Ear spoonerDark Blue 10pcsDark Blue 1pcDark Blue 5pcsgreen Ear spoonerMacaron Green 10pcsMacaron Green 1pcMacaron Green5pcsorange Ear spoonerPink Ear spoonerPink Tweezers 10pcsPink Tweezers 15pcsPink Tweezers 1pcPink Tweezers 5pcsyellow Tweezers 1pcChoose an optionChoose an option4 pcs Setblue Ear spoonerDark Blue 10pcsDark Blue 1pcDark Blue 5pcsgreen Ear spoonerMacaron Green 10pcsMacaron Green 1pcMacaron Green5pcsorange Ear spoonerPink Ear spoonerPink Tweezers 10pcsPink Tweezers 15pcsPink Tweezers 1pcPink Tweezers 5pcsyellow Tweezers 1pcClearCHINAUnited StatesRussian FederationChoose an optionChoose an optionCHINAUnited StatesRussian FederationRated 0 out of 5

Best Seller

-

2pcs Wooden Baby Hair Brush Comb Soft Baby Bath Brush Clean Hair Body Gentlely Baby Protect Shower Baby Wash Care Tool

$4.96ClearAs ShownChoose an optionChoose an optionAs ShownRated 0 out of 5 -

Beech Wood Round Baby Pacifier Clip Wooden Felt Ball Pacifier Chain Silicone Beaded Baby Nipple Dummy Holder Chain Care Chew Toy

$6.19ClearPinkBrownGRAYKhakiPURPLEChoose an optionChoose an optionPinkBrownGRAYKhakiPURPLERated 0 out of 5 -

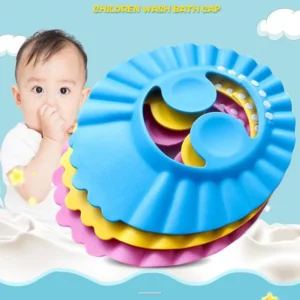

Adjustable Baby Shower Hat Toddler Kids Shampoo Bathing Shower Cap Wash Hair Shield Direct Visor Caps for Baby Care 1pc

$8.28 – $8.31CleargreenPinkYellowChoose an optionChoose an optiongreenPinkYellowRated 0 out of 5 -

Cartoon Baby Shower Bath Spoon Head Watering Bottle Todder Kids Wash Hair Bailer Shampoo Cup & Cap Infant Care Tool

$7.41 – $7.62ClearBlue Shampoo CapEar Shampoo Cap-BlueEar Shampoo Cap-PinkEar Shampoo Cap-YellPink Shampoo CapYellow Shampoo CapChoose an optionChoose an optionBlue Shampoo CapEar Shampoo Cap-BlueEar Shampoo Cap-PinkEar Shampoo Cap-YellPink Shampoo CapYellow Shampoo CapRated 0 out of 5 -

Cute Cartoon Bear Cat Nail Clippers Cutter for Student Girls Beauty Household Nail Trimmer Scissors Baby Nail Care Manicure Tool

$6.30 – $6.57Clearbeige bearBeige cat pawBeige donutBirthday BearBowCoffee donutsHooded catRadish Bearrandom colorChoose an optionChoose an optionbeige bearBeige cat pawBeige donutBirthday BearBowCoffee donutsHooded catRadish Bearrandom colorRated 0 out of 5 -

Baby Plastic Cleaning Tweezers Safety Care Round Head Clamp Anti-skid Design Clean Ear Holes Nostrils Forceps Babies Daily Care

$6.33 – $21.964 pcs Setblue Ear spoonerDark Blue 10pcsDark Blue 1pcDark Blue 5pcsgreen Ear spoonerMacaron Green 10pcsMacaron Green 1pcMacaron Green5pcsorange Ear spoonerPink Ear spoonerPink Tweezers 10pcsPink Tweezers 15pcsPink Tweezers 1pcPink Tweezers 5pcsyellow Tweezers 1pcChoose an optionChoose an option4 pcs Setblue Ear spoonerDark Blue 10pcsDark Blue 1pcDark Blue 5pcsgreen Ear spoonerMacaron Green 10pcsMacaron Green 1pcMacaron Green5pcsorange Ear spoonerPink Ear spoonerPink Tweezers 10pcsPink Tweezers 15pcsPink Tweezers 1pcPink Tweezers 5pcsyellow Tweezers 1pcClearCHINAUnited StatesRussian FederationChoose an optionChoose an optionCHINAUnited StatesRussian FederationRated 0 out of 5 -

1 Roll 2.5/5/10cm*4.5m Gauze Bandage Self-adhesive Breathable Elastic Bandages Sports Fixing Finger Wrist Leg Baby Care

$7.50 – $9.21BluegreenRedblackPURPLESkinSKY BLUEWhiteChoose an optionChoose an optionBluegreenRedblackPURPLESkinSKY BLUEWhiteClear10CMx4.5M2.5CMx4.5M5CMx4.5M7.5CMx4.5MChoose an optionChoose an option10CMx4.5M2.5CMx4.5M5CMx4.5M7.5CMx4.5MRated 0 out of 5 -

Adjustable Baby Swim Cap Bath Shampoo Eye Protection Head Shower Water Cover Baby Care Wash Hair Shower Cap For 0-6 Years Kids

$3.79 – $12.76ClearBlue 1Blue 2Blue 4Pink 1Pink 2Pink 4Yellow 1Yellow 2Yellow 4Choose an optionChoose an optionBlue 1Blue 2Blue 4Pink 1Pink 2Pink 4Yellow 1Yellow 2Yellow 4Rated 0 out of 5

Subscribe to Our Newsletter

Don't Miss Out!

Get the latest on sales, special offer, new releases and more…